Navigate your journey to financial freedom through property ownership and investment, properly.

plinkoAt Properli, we firmly believe the best way to achieve the lifestyle you want is through strategic investment in property.

Our integrated services support your goals from the start to end – from getting a first or new mortgage, to refinancing, risk insurance to investing in property to grow future wealth.

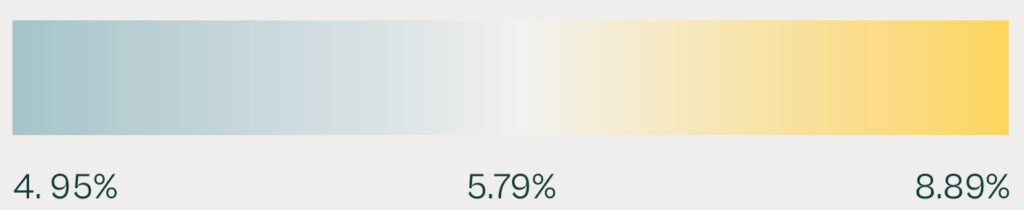

If your mortgage rate is up

for renewal, contact our

team to secure the lowest

rate available.

Let us guide you through your property investment journey and build a strong financial foundation.

Make an informed purchase with our latest free property investment data reports.

Start your journey us. With over 20 years of experience in Property and Finance, and 12 years in the New Zealand market, we’ve helped countless Kiwis achieve their dreams, whether big or small.

Whether you’re applying for a first home loan, a current homeowner, self-employed looking for lending options, or a property investor growing your portfolio – our Advisers can help you achieve your goals.

Secure a lower home loan rate, a reduced term or consider debt consolidation. By Refinancing, we help you reduce your monthly repayments, increase your cashflow or release equity to invest in property.

Get personalised advice and options to protect your assets, income, investments, and lifestyle from unforeseen changes that could impact your journey to financial freedom.

A proven and tangible way to create proper long-term wealth to achieve the lifestyle you wish for. Buy new builds, in high growth regions with great rental yield. Talk to the experts.

At Properli, we also design and build our own quality residential developments ideal for first time and existing investors looking to grow their property portfolio.

These rates are sourced and supplied to Properli from businessdesk.co.nz/mortgage-rates

Navigating the world of mortgages can feel like a complex maze, especially as interest rates begin to ease after a few turbulent years. More Kiwis are looking for smarter ways to manage their home loans without having to change the way they live or spend. Two increasingly popular tools that help reduce

Entering the world of property investment can be exciting, but it can also be overwhelming for first-time investors. The good news is that with the right guidance, you can avoid the most common mistakes that lead to costly errors. At Properli, we’re here to help you navigate the complexities of property investment

After a period of cooling due to government regulations, rising interest rates, and broader economic uncertainty, property investors in New Zealand are making a noticeable comeback. Recent market trends indicate a growing confidence among buyers, spurred by stabilising interest rates, a strong rental market, and renewed optimism in long-term capital gains. In

Join our mailing list and you’ll be sent our monthly newsletter which keeps you up-to-date with the latest financial, property market and property investment news.