Invest in property which can grow in value & create a steady income – a smart, reliable way to achieve financial freedom.

At Properli, we connect everyday Kiwis with experienced investment advisers who specialise in helping you grow wealth through smart, strategic property investment. Our advice is backed by data and insights from our vertically integrated property and finance group – giving you a clear, informed pathway to long-term success.

A combination of lower borrowing costs and stable rental income is giving investors the chance to acquire properties that are close to cashflow-neutral. A scenario that hasn’t been seen in years.

Many of Properli’s pre-vetted properties are achieving rental yields of 4–5%, and with interest rates trending downward, investors can often offset most or all of their holding costs. This makes property investment accessible for a broader range of buyers and is especially attractive for those using negative gearing strategies, covering property costs through rental income while aiming for long-term capital gains.

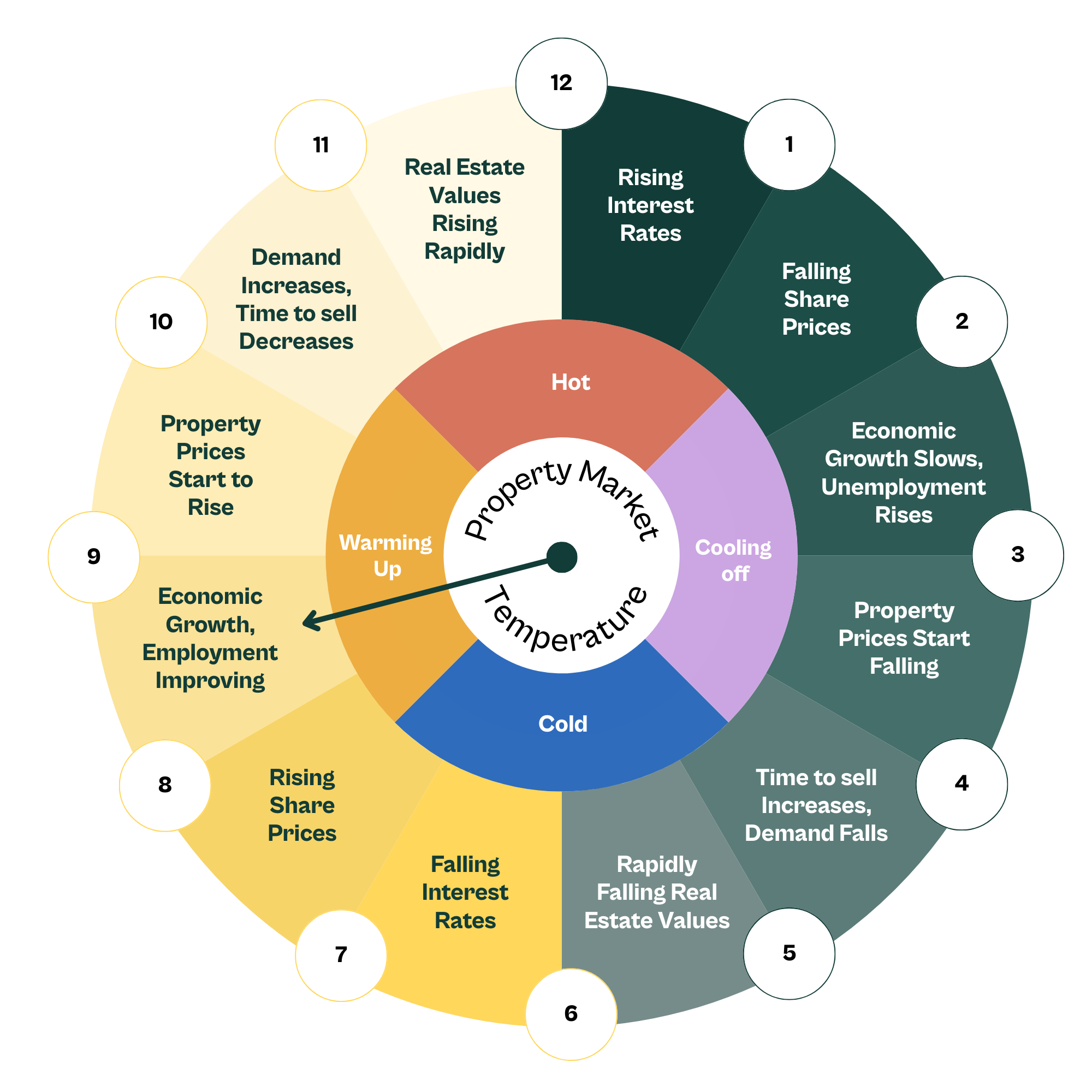

We’ve recently moved around the property clock, from stage 7 to stage 9 making it an ideal time to invest with economic growth and employment rates improving.

Work out your typical cashflow by using our Investment Property Calculator:

In these case studies, we talk about real client experiences, who we’ve worked with to make their property investment ambitions a reality.

Whether you’re a first home buyer, an existing homeowner needing to refinance, or self-employed looking for lending advice Properli Advisers will design solutions and pathways to achieve your property ownership goals.

Get personalised advice and options to protect your assets, income, investments, and lifestyle from unforeseen changes that could impact your journey to financial freedom.

Learn first hand the benefits of property investment from two of the Properli team members who have been there and done it. Meet Sanjeewa (Sanj) Silva, Properli Partnerships Manager. Sanj has an extensive background in the finance industry, having worked at a high level with banks and sporting organisations. A successful property

Investment property is a great way to generate passive income and build wealth over time. However, buying an investment property and getting a mortgage in NZ requires a significant amount of upfront capital (sometimes up to 40% or more), as well as a good understanding of the mortgage and local property market.

If you bought a property now for $500,000 and it increased in value by just 5% a year, guess how much it’d be worth in 5 years? $638,000, and in 10 years it’d be worth $814,000. Here is how you can create wealth through proven and tangible property investment. 1. Set goals