Discover the power of falling interest rates and how they impact the Property Cycle. Lower interest rates can open doors for property buyers and create favourable conditions for property investment. What does this mean for you?

First up, what is the Property Cycle and what is it used for?

The diagram above is called the Property Cycle or Property Clock. It is a real estate tool to help buyers understand and predict the phases of the Property Market. It’s typically represented as a clock face, with each hour indicating a different phase in the market cycle. Investors and analysts use the Property Clock to gauge where the market is in its cycle and to make informed decisions about buying or investing, selling, or holding property. By understanding the current phase, they can better anticipate market trends and potential opportunities or risks.

What do Falling Interest Rates mean?

- Lower interest rates reduce the cost of borrowing for people. This means that potential buyers can afford to borrow more money for the same monthly payment, making it more achievable to purchase a property, stimulating the property market. Use our calculators to work out potential mortgage repayments using the latest mortgage interest rates.

- Ready to purchase a property? Now is a great time to buy a home to live in or an investment property, while it’s still a buyers market with many property listings.

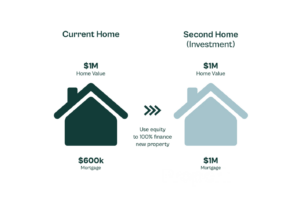

- If you are a homeowner with an existing mortgage, speak to your Financial Adviser about refinancing your loan to take advantage of the lower rates, potentially reducing your monthly payments or pulling out equity from your home.

- Attention first home buyers! With lower borrowing costs, securing the loan amount you want might now be achievable, enabling you to jump on the property ladder sooner. If you’re a first home buyer and want to learn more about getting a mortgage and how to purchase a property DOWNLOAD our First Home Buyers Guide.

Is 2024 the time to get into Property Investment? Hear first hand about how two of the Properli team members have done it themselves!

Interested in proper Property Investment Advice, speak to one of our Advisers. We have relationships with developers with on and off market properties, ideal for property investment with rental yields from 4-5%* ready to buy today.

Speak to an Adviser specifically about Property Investment today.

No finance sorted? Don’t worry, our team of Financial Advisers can help. Read more about how to Invest in property and get a mortgage in NZ.

*This is an estimated rental yield %. Exact rental yields are unique to each investment property.