This week, the RBNZ bank dropped the OCR by 50 basis points to 3.75%. If passed on by the banks, a 50 basis point (0.50%) drop in mortgage rates would reduce the interest paid on a mortgage, lowering the monthly repayments. By refinancing, you could reduce your monthly payments by locking in a new low rate or adjust your term – either with your current bank or a new one by switching lenders.

Did you know, if you’ve got a $750,000 mortgage on a 30 year term, currently on an interest rate of around 6.5%, and you refinanced to a new low rate of 4.99%, you could save around $714.35 per month, that’s a $164 per week!

What could you do with a saving like this?

- Save it in a standard savings account gathering compounding interest?

- Use the saving to support the cost of living and household expenses?

- Keep your mortgage repayments the same and reduce your term (saving you in overall interest paid)?

- If you have sufficient equity and enough for a deposit, would you put this saving towards an investment property?

If you kept your repayments the same for a $750,000 mortgage at 6.5% interest rate but reduced the mortgage term from 30 years to 20 years you could save $279,173 on interest repayments over the complete loan term ($808,983 on 30y vs. $529,810 on 20y).

But property is where the significant gain can be.

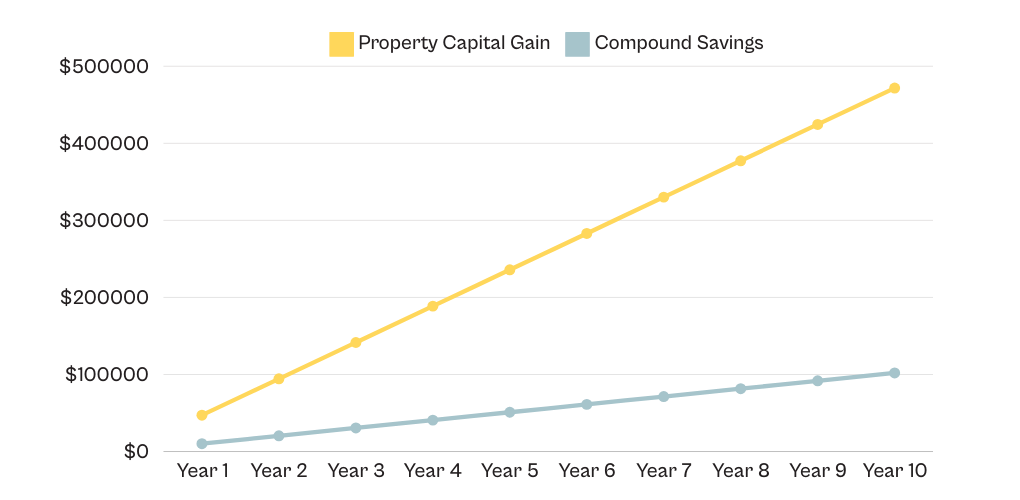

Let’s compare the capital growth variance between saving vs. investing over a 10 year period:

- Put $164 a week into a savings account with 3.5% compounding interest

- Use $164 a week to top up an investment property

Scenario 1: Saving $164 per week with Compound Interest

Assumptions:

- Weekly deposit: $164

- Interest rate: 3.5% per annum

- Time: 10 years

The estimated amount in the savings account after 10 years would be $101,933 with a total interest gain of $16,653.

Scenario 2: Using $164 per week to Invest in a Property

Assumptions:

- You use the $164 per week towards a property

- The property appreciates at 5% per annum.

- Your loan interest rate is 5% per annum

- Your property value starts at $750,000.

- You have 100% leverage (loan-to-value ratio).

The estimated property value growth over a 10 year period is approximately $471,671 capital gain.

The graph below shows the growth over a 10 year period comparing compounding interest on a savings account (using an average of 3.5% interest rate) vs. capital growth on an investment property.

The difference is eye watering!

Key takeaways:

✅ Property benefits from leverage—your investment grows based on the entire property’s value, not just your extra payments.

✅ You can save on total interest paid on your mortgage if you maintain your monthly payments but reduce your loan term.

✅ A savings account is less risky, but returns are much lower over time.

The OCR drop could benefit home buyers in several ways:

- Increased borrowing power: Buyers may qualify for larger loans as repayments will be lower on lower rates.

- Higher demand for housing: More affordability can drive up property prices, depending on supply. We’re already seeing the property market heat up this year.

- Relief for existing borrowers: Homeowners with floating rates or upcoming fixed-rate expiries will benefit if they refinance their mortgage with expert advice.

Time to speak to an Adviser about refinancing your loan? Take action towards your financial future.

Give us a call on (09) 361 0050 for a FREE consultation, or book time with an Adviser below.