Money is better in your back pocket, and by refinancing your loan you could be eligible for a mortgage cashback today. A mortgage cashback is a lump sum of payment that your bank or lender offers you as an incentive for choosing or switching a home loan with them. It’s like the cherry on top for first home buyer’s loans or customers refinancing who switch banks. but it comes with a few strings attached.

How Does Mortgage Cashback Work?

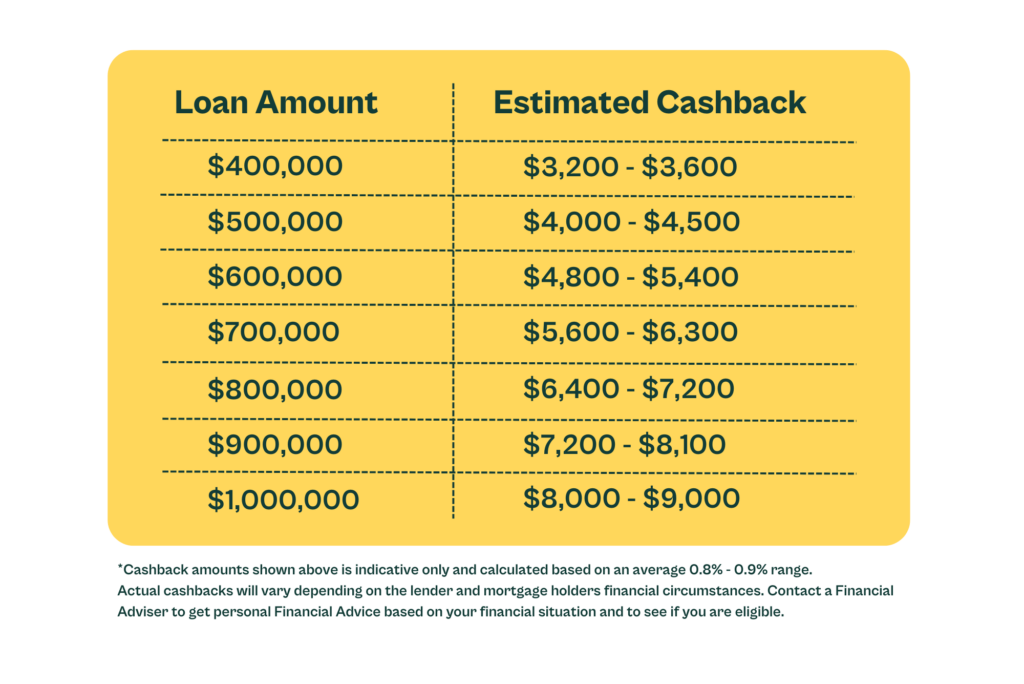

Cashbacks can vary significantly depending on the lender and the size of your mortgage. Typically, they are calculated as a percentage of your mortgage balance, often ranging from 0.8% and 0.9%. For instance, if you have a $500,000 home loan with a 0.8% cashback, you could receive about $4,000. Most lenders impose a cap on the cashback incentives they offer, regardless of the total loan amount. See the table below, for some estimated Cashback rates depending on the loan amount you have.

Benefits of a Mortgage Cashback

When considering a mortgage cashback, it’s important to weigh the immediate benefits against the long-term implications. Here are a few tips to help you make an informed decision:

- Help With Upfront Costs

A cashback can help cover costs like legal fees, valuation fees, moving expenses, or even home improvements.

- Extra Financial Flexibility

It provides additional cash that can be used for emergencies, paying down debt, or contributing to your savings.

- Competitive Offers Between Lenders

Many mortgage lenders offer cashbacks to attract borrowers, so it can be used as a negotiating tool when choosing a lender. It’s a competitive market out there, and lenders use cash backs to stand out from the crowd.

Considerations Before Accepting a Cashback

When considering a mortgage cashback, it’s important to consider the immediate benefits against the long-term implications. Here are a few tips to help you make an informed decision:

- Clawback Period

Most lenders will require you to stay with them for a certain period, (usually between 2-4 years). If you decide to refinance mortgage or pay off your mortgage early, you may have to pay back a portion, or in some cases, all the cashback you received. Understand the terms and conditions attached to the cashback. A Financial Adviser can help explain everything you need to know.

- Interest Rates and Fees

Sometimes, lenders offering cashbacks may have slightly higher interest rates or additional fees. Get a Financial Adviser to help calculate the overall cost of the loan rather than just focusing on the cashback amount. Sometimes a lower rate with no cashback can be more beneficial in the long term. Luckily, at the moment interest rates are coming down at most major NZ banks, presenting the best opportunity for mortgage holders to secure low and competitive rates.

Next Steps

- Make a booking with a Financial Adviser who can find, compare and recommend the best rates and refinancing terms for you, and do lots of the admin and heavy lifting for you.

- Understand the terms of the clawback period to avoid unexpected repayments.

- Once you have your Cashback, use the cash wisely, such as putting it toward your mortgage, home improvements, or savings.

Mortgage cashbacks can be a tempting incentive for Kiwis to switch lenders when it comes time to refinance their mortgage and can provide financial boost to help you get where you want to go in the short term. Work with Properli to refinance your loan this year and we’ll let you know if you’re eligible for a Cashback.

Book a Free Refinance Advice meeting today.

Let’s get started.