New Zealand house prices have experienced rapid both growth and decline in recent years, the typical boom and bust cycle that we see in the NZ property market.

The Reserve Bank of NZ explains in its latest Financial Stability Report, that the drivers are a result of interest rates changes, government policy changes, population growth trends and new housing supply. With recent aggressive mortgage rate cuts by major NZ banks, a lift in buyer sentiment is likely which suggests the property market will improve before the end of the year.

Consumer research carried out by OneRoof after August’s OCR drop to 5.25% reinforces this positive consumer sentiment and suggests that Kiwis are feeling better about the housing market:

- 40% feel the economy will improve over the next 12 months;

- 41% feel the affordability of houses will slightly improve over the next year;

- 54% feel the interest rate announcement will have a significant/moderate impact on them; and

- 21% will make a major decision surrounding property because of the interest rate drop

Source: 1000 OneRoof User Respondents. OneRoof

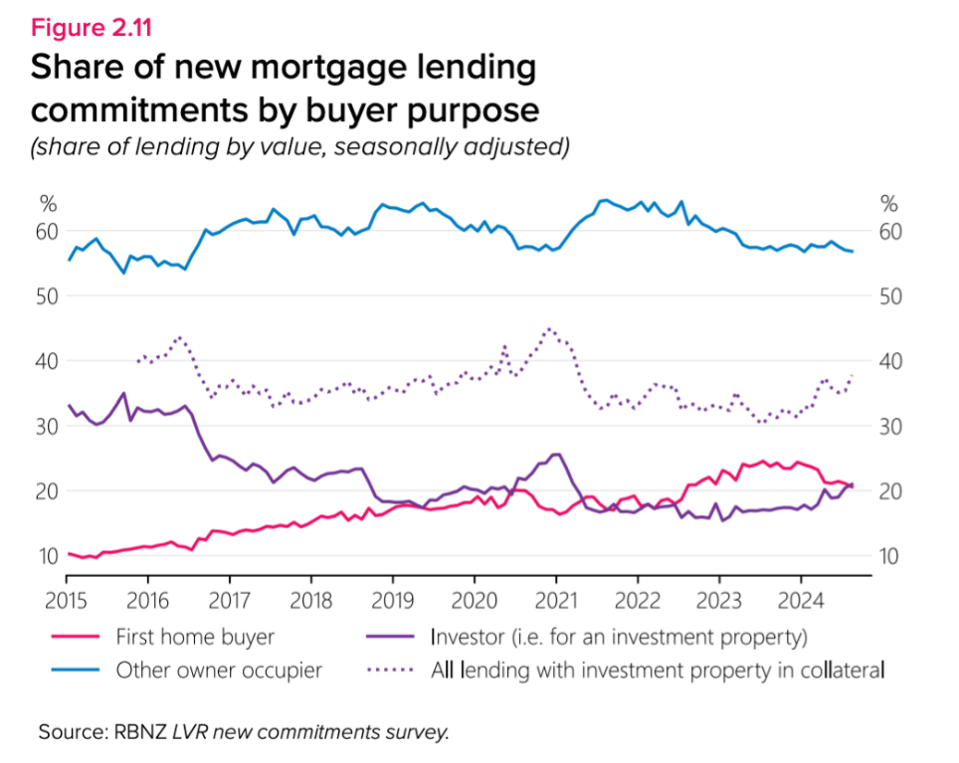

With lowering test rates, the debt capacity borrowers have is more promising. In the past 12-18 months, the RBNZ has observed an increase in First Home Buyers new mortgage lending commitments.

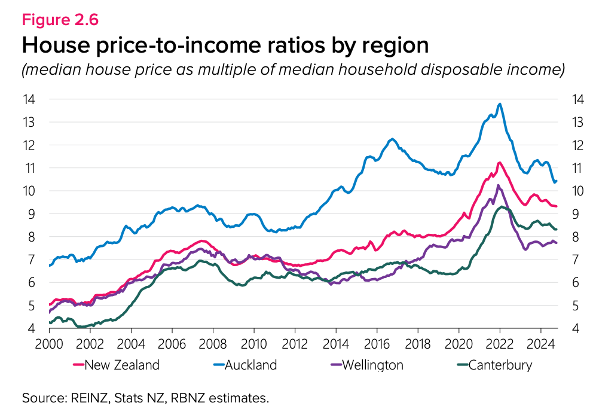

Activity in the housing market has picked up modestly over the past year, and we are seeing a recovery in sales volume as prices stabilise. Auckland and Wellington prices fell 20-23% respectively from their peak level in late 2021, prices have fallen an average of 14 percent nationally and have remained relatively flat over the past year. Where prices in Canterbury prices have strengthened over the past 18 months, after a modest decline.

When we compare regions on a range of medium-term metrics such as population growth, housing shortage (supply and demand), capital gain and rental yield, Auckland and Canterbury remain in the top performing regions for property investment.

Although the property market remained relatively sluggish in October, the pace of decline has roughly halved in the past couple of months after an average fall of around -0.9% from May to August.

CoreLogic NZ Chief Property Economist, Kelvin Davidson said that could be a sign of an approaching floor for property values. This shows us that the property market might be beginning to warm up again slowly.

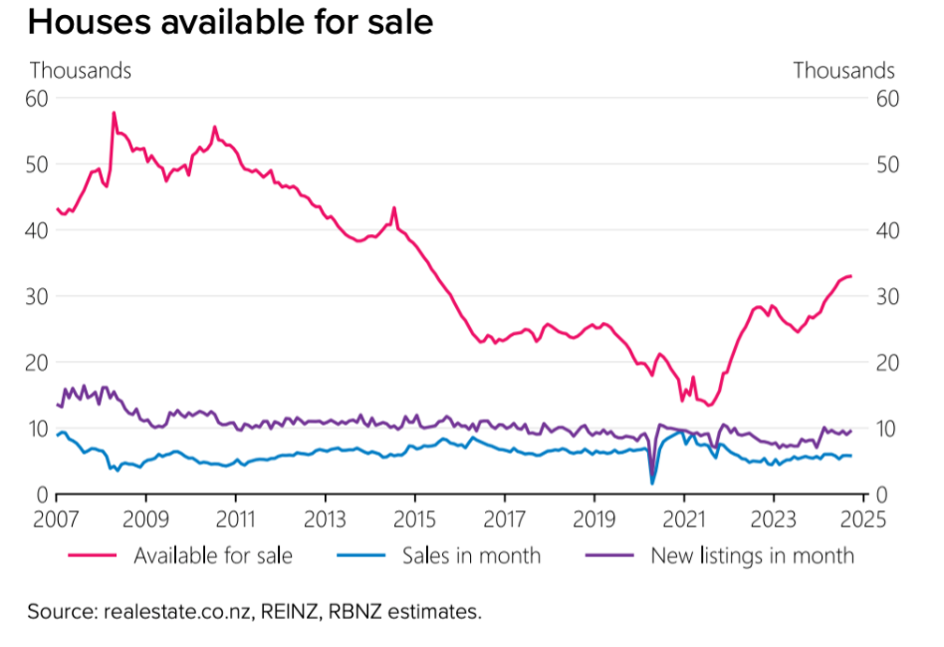

The annual number of new dwelling consents have fallen from its high of 51,000 in 2022 to around 34,000. As published in the August Properli Quarterly Property Investment Report, this means that supply of new builds could be lower than demand for a period. Values will increase when demand rises in approx. 12-18 months and Westpac believe that Consent Approvals are likely to keep dropping until mid – late 2025.

In terms of property sale listings, according to recent REINZ data and estimates, volume has recovered back to more typical levels and is predicted to continue growth, and the stabilisation of prices will create greater confidence with buyers.

The RBNZ explains, that recent tax policy changes are favourable for investors, with deductibility of mortgage interest costs from taxable rental increase set to increase to 100% in April 2025, currently 80%. This improves investors debt-servicing capacity. The share of new lending by buyers looking for an investment property has increased over the past few months, as interest rates reduce.

Those facing debt-servicing stress should contact a Financial Adviser, and seek advice on how to better structure and manage your loan.

Sources:

https://www.oneroof.co.nz/news/oneroof-house-price-report-october-2024-46304

REINZ, RBNZ estimates realestate.co.nz